📢 Webinar Alert 📢 "Elliott Wave Simplified: Mastering the Basics of Stock Market Analysis" Are you ready to take your trading skills to the next level??? Unlock Profitable Trading Opportunities with Elliott Wave Analysis... Join our exclusive webinar, where renowned financial expert Pratin Gandhi(having10+ years of experience) will guide you through the basics of Elliott wave principle... DATE: 07TH SEPTEMBER 2023 TIME: 8:30 P.M VANUE: ONLINE @ ZOOM LANGUAGE: HINDI / ENGLISH BOOK YOUR SPOT NOW!!! Key Points: 📈 Learn to Navigate Financial Markets: Discover the power of Elliott Wave Theory in decoding market trends and making informed trading decisions. 📊 Real-Life Chart Examples: Dive into practical chart examples that showcase the effectiveness of Elliott Wave analysis. 💡 Master Market Psychology: Understand how market psychology influences price movements and leverage it to your advantage. 📚 Interactive Q&A Sess...

Posts

LATEST POSTS

NICKEL:PATTERN INTERPRETATION

- Get link

- X

- Other Apps

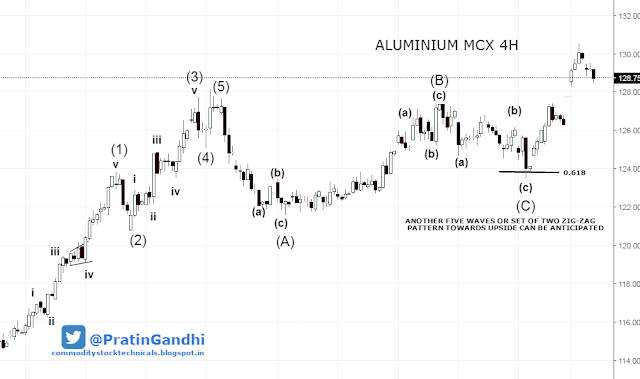

Nickel price chart formed 8 months long Head & Shoulder reversal chart pattern with very strong horizontal support standing near 640 levels. Evidence of H&S at the top can be considered as a bearish signal. Almost eight months long H&S top price target stands near 565. A short trade can be entered at the weekly close below 640 levels. From the charting perspective, there are several more bearish interpretation of the current price action. As per wave principle, an Impulse of five waves and a correction of three waves have been completed and another five wave impulse or a set of two correction waves can be anticipated . OUTCOME( POSTED ON 2ND JUNE 2017):

Crude Oil:Wave Analysis

- Get link

- X

- Other Apps

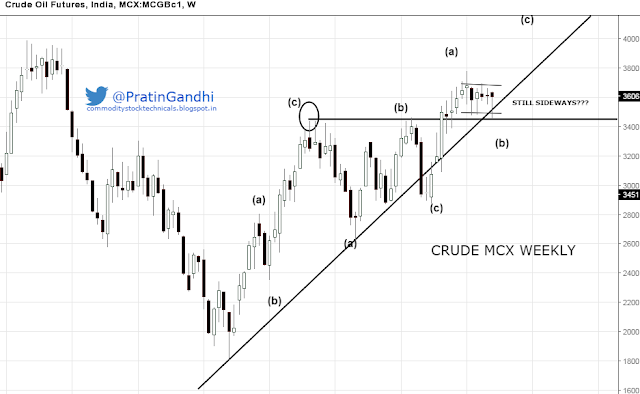

The graph given below can be the most probable wave count for Crude Oil (MCX India) in the Daily timeframe. The major trend of Crude Oil is likely to be up. The current trend might be down and might be going towards 3440-3400 levels. The sub-wave (B) can be ended near 3440 to 3400.Check these levels if Price continue to go down Check the breakthrough at upper line of the consolidations if price go upward without testing the given levels

Important levels :Silver

- Get link

- X

- Other Apps

In weekly time frame, we can notice two hindrances for upcoming price movement.One strong resistance is last Dynamic level and one is trend line.Elliot's wave analysis is extremely subjective and at this stage, the market is not giving enough clues to get the exact market position.But somehow we can manage to trade with this important levels. See the Daily Silver chart for other important levels(Attached below).That might help you to plan a successful trade. Subscribe to my blog and receive a free email when I post.

Technical outlook- Crude

- Get link

- X

- Other Apps

Crude price has reacted against the Dynamic support and Trendline support.Can we consider this move as strong bull rally? I think we should wait for another clue that might appear at the upper line of that sideways correction . Read complete article based on technical analysis Elliot's wave analysis: Crude oil

Follow me on Twitter @PratinGandhi

WAVE STUDY OF CRUDE OIL#crudeoil #mcx #NCDEX #commoditystocktechnicals #Elliottwave

— Pratin Gandhi (@PratinGandhi) August 6, 2017

RT if u💗 pic.twitter.com/yL5sS1PSzK

A dream of thousands of technical analysts came true. Nifty at 10000.#nifty #nifty10000 pic.twitter.com/rXq5lba1j5

— Pratin Gandhi (@PratinGandhi) July 26, 2017

Gaps are always tricky. #copper#mcx #commodity #basemetal#commoditystocktechnicals pic.twitter.com/Gn6tQEHo1v

— Pratin Gandhi (@PratinGandhi) July 25, 2017

#nifty Maintaining the channel.#nifty50 #bse #nse #commoditystocktechnicals pic.twitter.com/NcVImyik5R

— Pratin Gandhi (@PratinGandhi) July 24, 2017

#Nifty #BSE #NSE

— Pratin Gandhi (@PratinGandhi) July 11, 2017

Bull trend initiated near the cluster. pic.twitter.com/J2Vf5pBnY3